There are advertisements everywhere these days from companies begging to loan you money. Get a fast cash loan with no questions asked. If you need money for rent and your paycheck is still a week or two away then there are companies that make a business out of fronting you that money. These are usually referred to as payday loans and they typically come with a hefty price tag of their own.

Having someone offer up a fast cash loan is tempting. It is especially tempting when you are one of many working class citizens who desperately need those liquid funds in a hurry. Without looking too hard, though, it is possible to find a lot of horror stories about these loans going wrong. TV news magazines often report on consumer affairs by trashing a lot of places who promise cash loans fast.

Having someone offer up a fast cash loan is tempting. It is especially tempting when you are one of many working class citizens who desperately need those liquid funds in a hurry. Without looking too hard, though, it is possible to find a lot of horror stories about these loans going wrong. TV news magazines often report on consumer affairs by trashing a lot of places who promise cash loans fast.

In truth they aren’t all that bad. While there are certainly companies out there that are designed to take advantage of consumer vulnerability, most of the payday loan companies play firmly within the laws of their state.

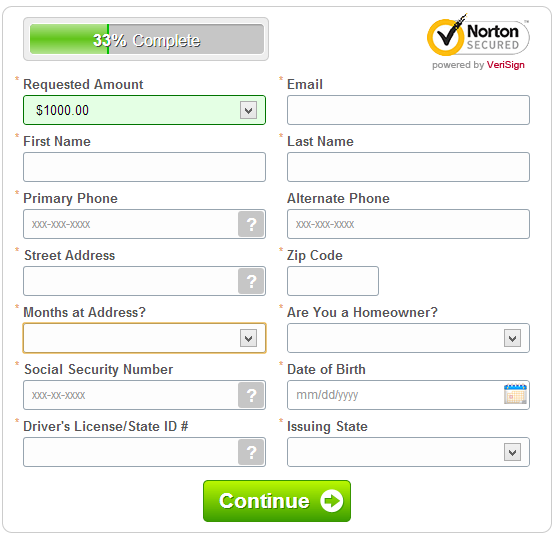

How are they able to give out such fast cash loans? After all, banks put clients through pages of paperwork before letting any of their money go.

The workings of these corner store loan shops is simple. Their main means of operating is that they give out only small amounts of money at a time. Usually one or two hundred dollars and extremely rarely is it up to or over a thousand. To get their fast cash loan the borrower generally writes a check. The check is made out to account for the amount borrowed as well as a service fee. This fee is most often a percentage of the borrowed total, but some places will add a flat fee for specific increments, such as five dollars charged for every fifty dollars borrowed. If the borrower can’t pay the loan back at the given time then the penalty is usually the fees being charged again.

The biggest problems arise when people are so involved in getting a cash loan fast is that they don’t pay attention to the rules and conditions. There is a Truth in Lending Act that stipulates all lenders must clearly outline their fees before the loan is given out. For this to be useful though, the person borrowing the money has to pay attention. It’s when they aren’t focusing or ignore these stipulations that more money problems arise.

For that reason and others it is a good idea to find alternative places to get money. Besides the fact that businesses offering fast cash loan charge a fee far higher then par, there are other money sources that are more forgiving. Before resorting to the local payday loan shop consider those alternatives.

If you have even a day or two to spare then try getting a loan through a credit union or a small loan company. Not only would this solve your money problems but help you establish future credit. For even more cost effectiveness, ask your employer for an advance on your next check or turn to family or friends.

Still the best way of avoiding the costly practice of going to fast cash loan stores is planning ahead. No matter what your regular income is, it’s always a good idea to budget every month ahead of time. Then, so long as nothing urgent and unexpected comes up, you won’t have to worry about loans or fees.

No comments:

Post a Comment