Lots of people need a short term loan at least one or twice in their lives, and many of them either don't have a friend or family member to borrow from, or they'd rather not ask them for help.

Often, the only available alternative is to take out what is commonly known as a 'fast cash loan', and there are several types of them available such as, payday loans, instant online payday loans, and instant cash loans etc. but whatever name they go by, they all have one thing in common and that's that their interest rates are exceptionally high.

Often, the only available alternative is to take out what is commonly known as a 'fast cash loan', and there are several types of them available such as, payday loans, instant online payday loans, and instant cash loans etc. but whatever name they go by, they all have one thing in common and that's that their interest rates are exceptionally high.

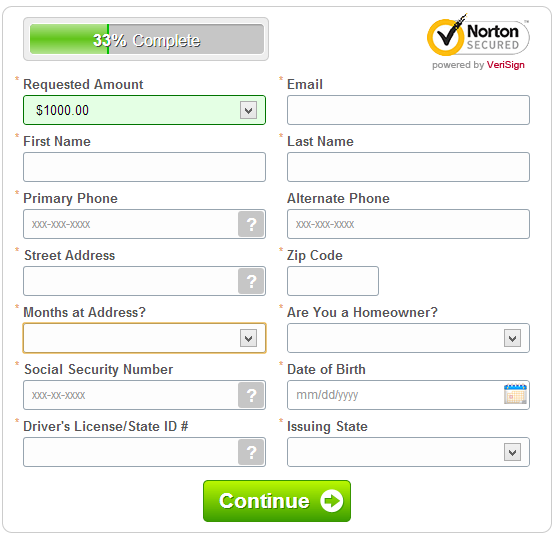

There are several upsides to these loans of course, and they are that almost everyone can qualify for one of them, they can be applied for on-line, and the money more often than not arrives within twenty four hours, except if you request one just before a weekend or a public holiday.

It's common thinking when needing one of these loans to simply think that the high interest is what it is, and that there's simply no way to avoid the elevated cost. This is not true however, because the amount that the borrower will have to pay back, can be reduced simply by following a few simple steps.

The most obvious first step, but often an overlooked one is not to request the loan until the very last moment, and the reason for this is that you'll begin paying interest of perhaps 20% per week from the moment you get the money. In the same vein, you should pay it back as soon as you possibly can, because the last thing that you want is for the loan to roll over and to have interest added to the interest.

Rather surprisingly, it's quite common for people that have poor credit ratings to borrow much more than they actually need when they apply for a 'fast cash loan', simply because they know that their credit won't be checked. Frequently, the only available option is to take out what is commonly known as a 'fast cash loan', and there are several types of them available such as, instant online payday loans, payday loans, and instant cash loans etc.

After you've figured out the minimum that you can make do with and you know the latest date that you have to have it by, you should start comparing some online companies and carefully check both the interest rates and the terms of the loan because they'll both vary quite a lot. Check to see, if the loan is for a fixed term such as a week or a month, if there are any upfront charges, if there is a minimum amount that you have to borrow, and last but not least, how long it will take for you to get your hands on the money.

In conclusion, be sure that a 'fast cash loan' is really what you need, and that a different type of loan wouldn't better suit your needs. There are many different types of loans available and they will all be cheaper than a 'fast cash loan', and many of them won't take much longer to process.

If you're credit rating is reasonably good and you can wait just a few days for approval, then consider that route, and if you have a good income and some equity then you'll save yourself a lot of money and pressure by taking out a loan for a couple of thousand dollars that's repayable over a much longer period of time.

If you don't have time, a good credit rating or some kind of equity, but you do have a good friend or family member that can help, then do consider telling them that you're about to take out a short term loan and tell them what it's going to cost you. The chances are good that they'll help you, but make sure that you pay them back on time too, because losing friendship is far worse than losing money.

No comments:

Post a Comment